A lot of buyers are waiting for rates to fall into the fives before they make a move. It sounds smart, but the truth is, the savings everyone is hoping for may already be here.

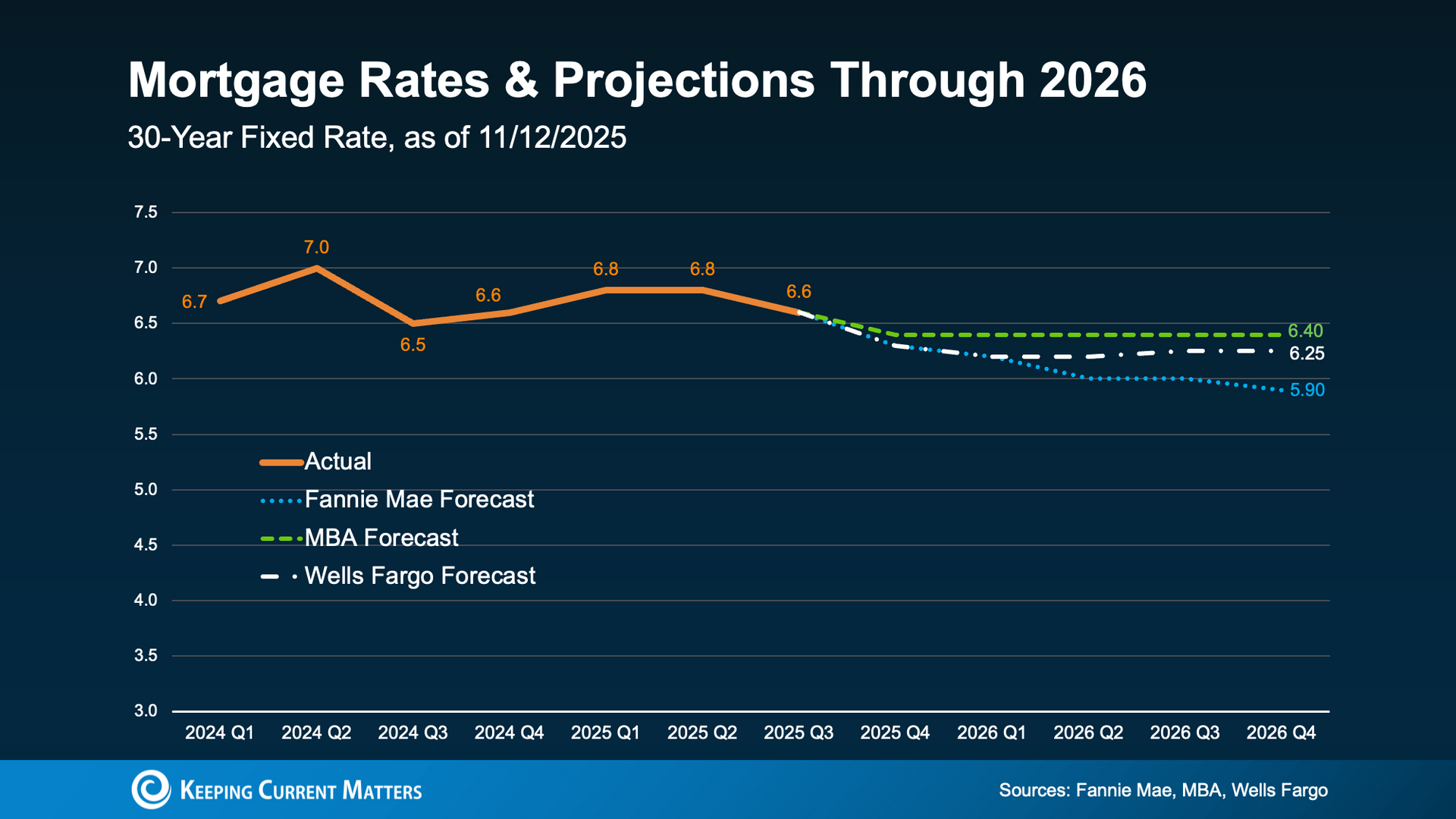

Rates peaked above seven percent in May. Since then, they’ve eased into the low sixes, and that shift alone has already dropped the typical monthly payment on a four hundred thousand dollar home by nearly four hundred dollars. That’s a real difference for anyone who pressed pause earlier this year.

Most experts say rates will stay close to where we are now through 2026, with only one prediction dipping into the high fives.

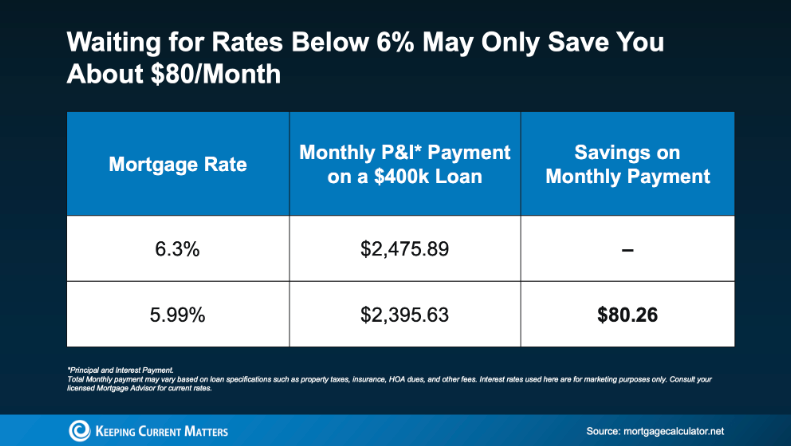

And even if rates do hit 5.99 percent, the math may not be as life-changing as you think. On an average priced home, that drop only saves you about eighty dollars a month.

Eighty dollars isn’t nothing, but it’s nowhere near the nearly four hundred dollars buyers are already saving right now. And once rates slide under six percent, more buyers will jump back in, competition will surge, and prices could rise enough to cancel out that extra savings anyway.

So the real question is simple. Is waiting for eighty dollars worth missing the opportunities you have today?

If you run the numbers and find a home you love, moving now may put you ahead of the crowd rather than in the middle of it.

Article sourced from keepingcurrentmatters.com

~Roni