The Federal Reserve meets this week, and all signs point to a rate cut. But before you get too excited, here’s what that really means for mortgage rates.

The Fed Doesn’t Set Mortgage Rates

The Federal Funds Rate is the short-term rate banks charge each other…it’s not the same as mortgage rates. Still, the Fed’s decisions often influence where mortgage rates go next.

Markets Already Priced This In

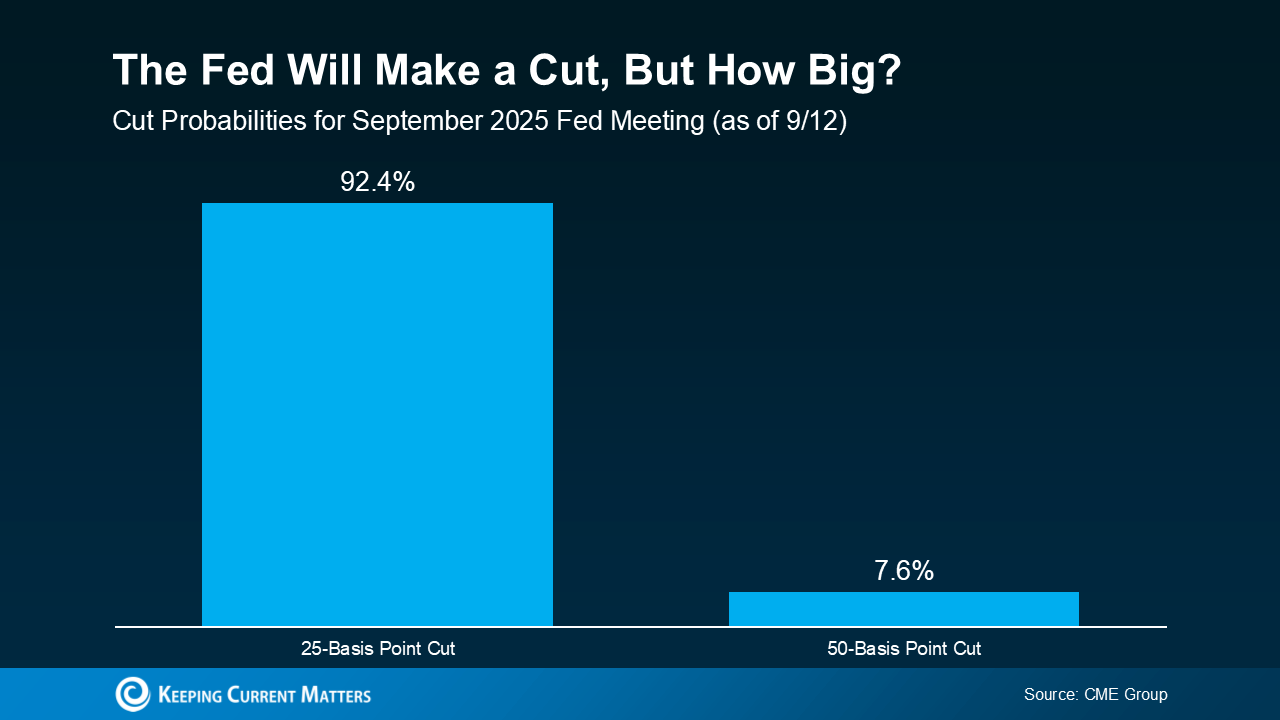

Investors have been expecting a cut for weeks, especially after weaker jobs reports in August and September. That’s why mortgage rates have already edged down recently. A 25-point cut is likely, and that’s mostly baked in (see graph below). A larger 50-point cut, while less likely, could move mortgage rates lower.

More Cuts Could Come

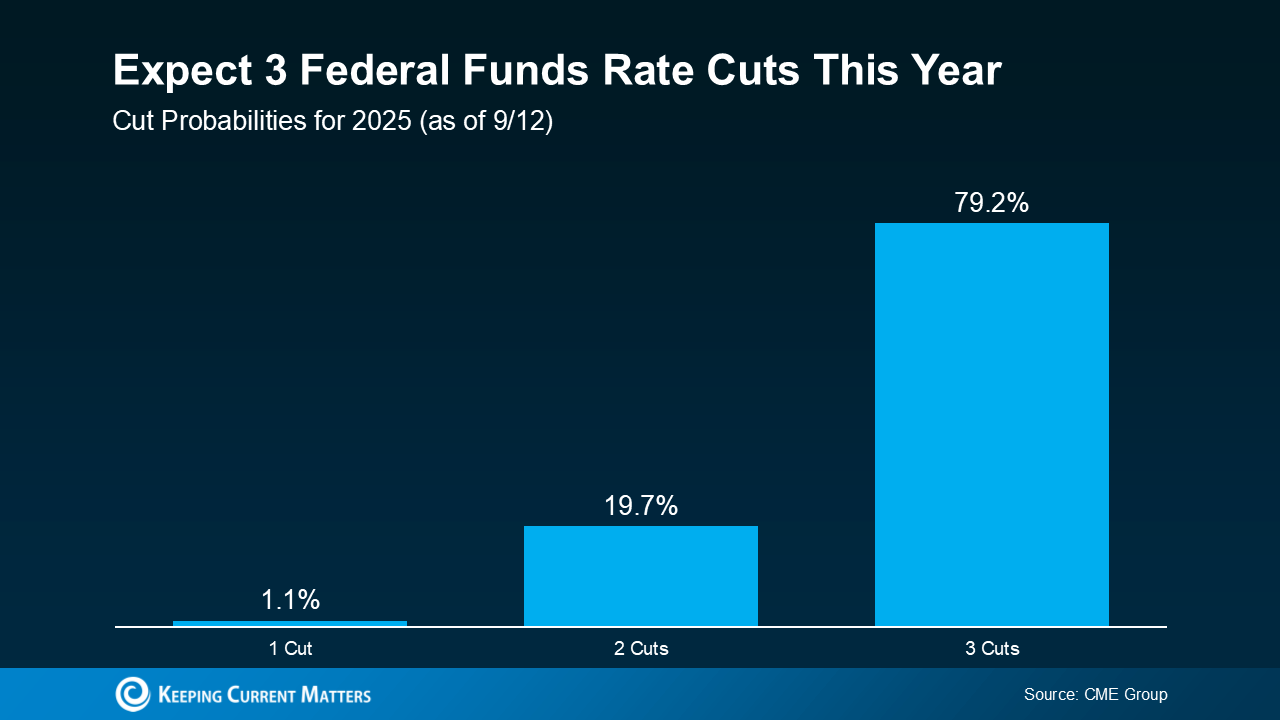

The bigger story is what happens after September. Markets expect the Fed could cut rates multiple times before year’s end. If that happens, mortgage rates may trend lower into late 2025 and 2026.

Mortgage rates won’t fall in lockstep with the Fed, but if rate cuts continue, affordability could improve. Even small changes in rates can make a big difference, so now’s a smart time to talk strategy.

Connect with me today, and I’ll walk you through what’s working right here in Summerville and the Charleston area.

~Roni

Article sourced from KeepingCurrentMatters.com